All Categories

Featured

Table of Contents

Indexed universal life policies supply a minimum surefire rates of interest, additionally referred to as a rate of interest crediting floor, which minimizes market losses. As an example, state your cash value sheds 8%. Indexed Universal Life accumulation. Numerous business offer a floor of 0%, implying you won't shed 8% of your financial investment in this case. Know that your money value can decline despite having a flooring due to costs and other costs.

A IUL is a long-term life insurance policy that obtains from the properties of a global life insurance coverage policy. Unlike universal life, your cash value grows based on the performance of market indexes such as the S&P 500 or Nasdaq.

What makes IUL different from other policies is that a part of the exceptional payment goes into annual renewable-term life insurance policy (Indexed Universal Life protection plan). Term life insurance coverage, additionally called pure life insurance policy, warranties death advantage repayment. The rest of the worth goes into the total money value of the plan. Costs must be deducted from the value, which would certainly decrease the money value of the IUL coverage.

An IUL plan may be the right choice for a customer if they are looking for a long-lasting insurance item that constructs wide range over the life insurance policy term. This is because it supplies prospective for development and additionally keeps one of the most worth in an unsteady market. For those who have significant possessions or riches in up front investments, IUL insurance coverage will certainly be a fantastic wealth monitoring tool, specifically if somebody desires a tax-free retired life.

How much does Iul Interest Crediting cost?

The rate of return on the plan's cash worth varies with the index's motion. In contrast to various other plans like variable universal life insurance policy, it is much less high-risk. Urge customers to have a conversation with their insurance policy representative regarding the ideal alternative for their circumstances. When it involves looking after beneficiaries and taking care of riches, right here are several of the leading reasons that a person might pick to select an IUL insurance coverage: The cash value that can accumulate because of the rate of interest paid does not count towards profits.

This indicates a client can use their insurance policy payout instead of dipping right into their social safety money prior to they prepare to do so. Each policy should be customized to the customer's individual needs, particularly if they are taking care of substantial possessions. The insurance holder and the representative can pick the amount of danger they take into consideration to be appropriate for their demands.

IUL is a total conveniently flexible strategy in most cases. Because of the rate of interest of universal life insurance policy policies, the price of return that a customer can potentially obtain is higher than other insurance policy coverage. This is because the proprietor and the agent can take advantage of call alternatives to raise possible returns.

What is the most popular Iul Growth Strategy plan in 2024?

Policyholders might be attracted to an IUL plan because they do not pay capital gains on the extra cash money value of the insurance plan. This can be contrasted to other policies that call for taxes be paid on any cash that is secured. This implies there's a cash asset that can be gotten at any type of time, and the life insurance policyholder would not have to fret about paying taxes on the withdrawal.

While there are various benefits for an insurance holder to select this type of life insurance policy, it's not for everyone. It is crucial to allow the consumer understand both sides of the coin. Here are several of one of the most essential things to encourage a client to take into consideration before selecting this selection: There are caps on the returns an insurance holder can receive.

The very best alternative depends upon the customer's danger tolerance - Indexed Universal Life investment. While the charges associated with an IUL insurance coverage deserve it for some customers, it is necessary to be ahead of time with them concerning the costs. There are exceptional expense costs and various other management charges that can start to build up

No assured rate of interest rateSome various other insurance plan offer a rates of interest that is ensured. This is not the situation for IUL insurance. This is great for some, but for others, the unidentified changes can leave them feeling subjected and insecure. To discover even more concerning dealing with indexed universal life insurance policy and suggesting it for certain clients, connect to Lewis & Ellis today.

How long does Indexed Universal Life Financial Security coverage last?

It's crediting price is based on the efficiency of a stock index with a cap rate (i.e. 10%), a flooring (i.e.

8 Permanent life irreversible consists insurance coverage is composed types2 kinds life and universal lifeGlobal Cash money value grows in a participating whole life plan with rewards, which are stated yearly by the business's board of directors and are not assured. Money worth grows in a global life policy via credited rate of interest and decreased insurance coverage costs.

Who offers Indexed Universal Life Growth Strategy?

No matter how well you plan for the future, there are occasions in life, both expected and unanticipated, that can influence the monetary well-being of you and your enjoyed ones. That's a factor for life insurance coverage.

Points like prospective tax rises, inflation, economic emergency situations, and preparing for events like university, retirement, and even wedding celebrations. Some kinds of life insurance can assist with these and other issues also, such as indexed universal life insurance, or simply IUL. With IUL, your policy can be a funds, due to the fact that it has the prospective to build worth in time.

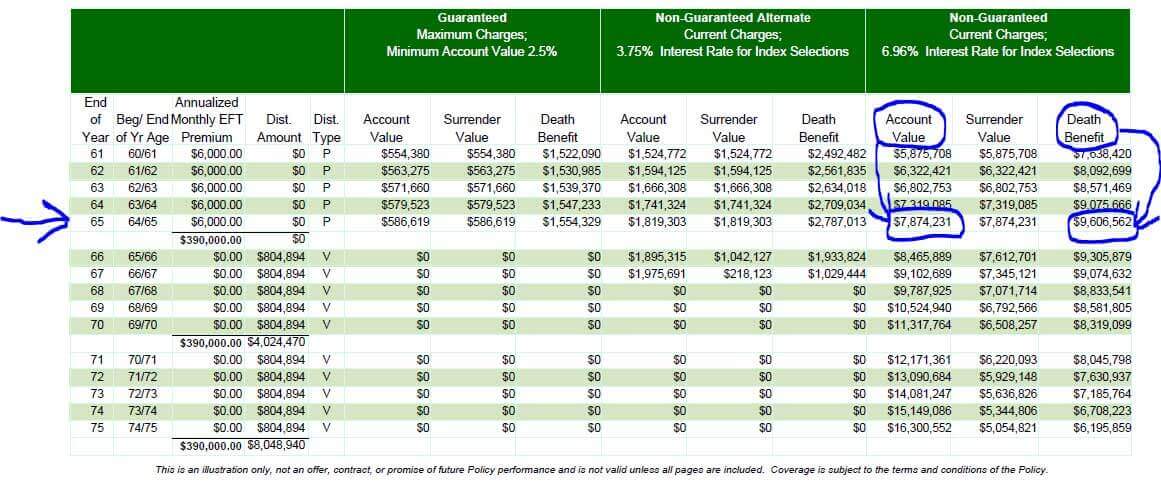

You can pick to receive indexed rate of interest. Although an index may impact your rate of interest credited, you can not spend or directly join an index. Here, your policy tracks, but is not really bought, an external market index like the S&P 500 Index. This theoretical instance is attended to illustratory functions only.

Costs and expenditures might decrease plan worths. You can also select to receive set rate of interest, one collection predictable passion price month after month, no issue the market.

Is there a budget-friendly Indexed Universal Life Premium Options option?

Because no solitary appropriation performs ideal in all scenarios, your economic professionalcan aid you establish which combination may fit your monetary objectives. That leaves more in your policy to possibly maintain growing over time - Indexed Universal Life tax benefits. In the future, you can access any type of readily available cash money value with policy financings or withdrawals. These are earnings tax-free and can be used for any purpose you desire.

Latest Posts

Guaranteed Universal Life Insurance Rates

Universal Life Insurance For Seniors

Index Assurance